DANCING NEBULA

When the gods dance...

Friday, August 31, 2012

HADRIANS WALL IN THE UK ILLUMINATED TONIGHT

Tell AG Holder: THROW THE BANKER CRIMINALS IN PRISON!!

Tell AG Holder: What’s the Holdup?!?

It’s time to throw Wall Street crooks in jail!

Banker Crime Spree is a project of Campaign for a Fair Settlement. The 'Holder Hold-Up' petition is a joint effort between Campaign for a Fair Settlement and its state allies as well as Campaign for America's Future.

Who's arming the developing world?

Weapons of mass distribution

Who's arming the developing world?

POLITICS: Talking crap in Holland v America

Fact-checkers Talking crap in Holland v America

Aug 31st 2012, 14:45 by M.S.

THE entire front page of the Volkskrant, one of the three top Dutch newspapers, is taken up today by an article about the misleading statements and inaccuracies in Paul Ryan's convention speech on Wednesday. This is interesting largely because the Netherlands is in the middle of its own election campaign, a pretty vicious one in which the leading parties are the laissez-faire Liberals and the far-left Socialists, and the vote is scheduled for September 12th. So you'd think the newspapers would be more occupied with their own country's political business than with controversies about who is or isn't lying in the American presidential campaign. One reason for the attention is that America really is a pretty important country. The other reason is that the story is piggybacking on an analogous controversy that's kicked up this week in the Dutch elections over truth, neutrality and budget assessments, and the comparison is instructive.

The Dutch have a system intended to avoid the sort of fact-free insult-hurling that has plagued America's presidential race this year. The discussion in America over the rival candidates' budget plans has taken place in a vague and undefined discursive space, largely because the Romney-Ryan campaign does not actually have a budget plan. Mr Romney says he will keep the Bush tax cuts, slash income tax rates across the board by 20%, eliminate capital-gains tax for income under $100,000 per year, maintain defence spending, restore the $716 billion over ten years which the Obama (and Ryan) budget would have cut from Medicare outlays, and shrink the budget deficit by closing tax preferences, none of which he specifies. This doesn't add up, as the Center for Tax Policy found last month, but it's hard to say just how it will fail to add up, because Mr Romney has no item-by-item budget plan; we really have no idea how much he proposes to spend if he's elected.

In the Dutch electoral system, this can't happen. Two months before the elections, every political party is expected to submit a detailed budget plan to a non-partisan agency called the Central Plan Bureau (CPB), which plays a role similar to the Congressional Budget Office in America. The CPB produces an analysis of the economic consequences of those budget plans. The effects are assessed in detail for 2013-2017, and there's also a prognosis for 2040 to discourage parties from larding up their budgets with short-term candy that leads to negative long-term consequences. The CPB's report came out Monday, and most parties had their strong and weak points. Of the two parties most likely to win the elections, the Liberals did well on deficit-cutting and long-term job creation but hiked income inequality and hurt household purchasing power; the Socialists did well on purchasing power and jobs in the short run but had low employment growth in the long run.

The Socialists, however, were angry about a separate point: the CPB found their plans to reduce free-market competition in the health sector would lead to waiting lists. The Socialists say this isn't true, that it depends how much you're willing to spend on the sector, and they say that question doesn't fall within the CPB's remit; they're not health-care experts, they're economic experts, and they're expected to simply report what the economic effects would be. That disagreement came on top of Socialist anger over another health-care clash during a candidate debate last Sunday. In the debate, the Socialist candidate, Emile Roemer, started to lay into the Liberal candidate and current premiere, Mark Rutte, for proposing to increase out-of-pocket expenses in health-insurance plans. Mr Rutte immediately denied that he had proposed to do so. Mr Roemer, like most political observers who believed the Liberals' plans to raise the out-of-pocket limit were public knowledge, was flummoxed. It turned out after the debate that Mr Rutte had worked out a complicated theory that his party's plans constituted a transfer of some types of expenses from one category to another, rather than a hike in out-of-pocket expenses as such; but fact-checkers ruled this claim was false, and that the Liberal proposal was basically a hike in the out-of-pocket limit. In the meantime, however, Mr Rutte had effectively shut down Mr Roemer's attack in front of prime-time viewers. Mr Roemer was widely agreed to have lost the debate, and the Socialists have declined in the polls this week.

The upshot is that, just as in America, the Dutch media are tossing around the question of whether neutral evaluations in the political campaign are worth anything. Some question the usefulness of the economic models the CPB uses, which (like all economic models) have never successfully predicted what the economy will do several years down the road. Others wonder whether the Dutch public pays any attention to fact-checkers, or whether a politician is better off scoring a telling point even if it turns out not to be true. Hence the headline of the Volkskrant article, which refers to the controversy over the Republican campaign in America but might as well be talking about the Dutch one: "The results count, not the truth".

What the comparison with the American example points out, though, is that, for all the current media scepticism, the mechanism of the CPB evaluation dramatically raises the caliber of the electoral debate in the Netherlands. Obviously such assessments are to a large extent artificial: the actual budget of the Dutch government will look nothing like any of the proposals submitted by the parties, because the government will be a coalition of several parties, and the budget will be the result of a negotiating process. The same thing happens in America, where the president's proposed budget bears only a vague relationship to what ultimately emerges from Congress. Nonetheless, by forcing each party to commit to hard numbers in its budget proposals, the CPB evaluation tethers the Dutch political debate to fiscal reality. Even the Socialists, the party most often accused of fiscal irresponsibility, have presented a plan full of cuts and tax hikes that eliminates the budget deficit by 2017. Arguably, this bias towards austerity is pro-cyclical and a bad thing in a liquidity trap; perhaps the Dutch system encourages too much probity, but that's a separate subject. The point is, it is simply impossible, in the Netherlands, for a political party to end up systematically ignoring math and accounting the way the Republicans have at least since George Bush's campaign in 2000.

Could we institute something like this in America? No. We can't. The reason is that in America, there are only two significant political parties. It's impossible for a neutral arbiter to preserve its public legitimacy when ruling on subjects of partisan dispute in an election if there are only two disputing parties. Neither side will accept the referee's judgments. The reason it works, for the moment, in the Netherlands is that there are currently ten parties represented in parliament, four to six of which are major contenders. That spreads the political polarities out in different directions and creates more space for neutrality.

Hopefully the Dutch will continue to recognise the value of these refereeing institutions despite the current bout of fashionable, world-weary "ah, but what is truth?" pique. As to why the American press is becoming disillusioned with the fact-checking project: a lot of it has to do with the country's debilitating division into just two bitterly opposed political parties. It's no surprise that this kind of Manichaean political landscape sucks away the space for any legitimate neutral arbiter. Imagine what would happen to the legitimacy of baseball umpires if there were only two teams in the Major Leagues, playing every single game against each other.

(Photo credit: AFP)

OUR COVERT WAR ON TERROR

Covert War on Terror

CIA Drone Strikes in Pakistan 2004 – 2012

Obama strikes: 291

Total reported killed: 2,558-3,319

Civilians reported killed: 474-881

Children reported killed: 176

Total reported injured: 1,226-1,359

For the latest Pakistan strike data click here.

US Covert Action in Yemen 2002 – 2012

Total confirmed US drone strikes: 39-49

Possible additional US operations: 114-129

Possible additional US drone strikes: 58-68

Total reported killed (all): 347-990

Total civilians killed (all): 58-151

Children killed (all): 24-31

For the latest data from Yemen click here.

US Covert Action in Somalia 2007 – 2012

Total US drone strikes: 3-9

Total reported killed: 58-169

Civilians reported killed: 11-57

Children reported killed: 1-3

For the complete data on Somalia click here.

FACEBOOK: MORE PRIVACY INVASION

New Facebook ad tech will let advertisers match your Facebook identity with their customer database

Facebook is working on new ad technology that will allow businesses you already buy from, but are not connected with on Facebook, match your email address and your Facebook identity. By connecting their customer records and your Facebook information, companies will be able to market to you better on Facebook … because they’ll know much more about you.

As reported by Inside Facebook, some Facebook Power Editor users (Power Editor is an advanced Facebook ad creation tool) saw the matching feature temporarily today:

Facebook confirmed to TechCrunch that this is a real product, explaining that businesses will be able to upload their customer lists (email addresses, phone numbers, and user IDs) to Facebook in an encrypted form, where they will be compared with Facebook’s user data, also in an encrypted form. The upshot of the process is that without the company getting access to all your Facebook data, and without Facebook getting access to the data that the company has about you, a link will be created between your identity with the company, and your identity on Facebook.

Which will allow the company to target you in Facebook ads tailored to what it knows about you … and tailored to what Facebook knows about you.

For example, Amazon could market books to you by authors you’ve already read. Or Target, knowing you’re already on its email subscriber list, might invite you to become a Facebook fan. Using Facebook ad technology, they could also tailor their message to married women ages 25-45 with children, knowing them to be heavy purchasers of home supplies.

Your privacy is maintained, in some sense: neither party that you gave information to is sharing it with the other party.

But users might well ask how much good that will do, when the process by which privacy is maintained enables companies to do basically anything they would be able to do if they had your full data.

According to Facebook, the feature is in private testing now, but will be available next week.

I for one am expecting some user resistance to the new targeting technology … and, more likely than not, a fairly strong response from governmental privacy watchdogs in Europe and America.

photo credit: Christi Nielsen via photo pin cc

The Federal Bailout That Saved Mitt Romney

The Federal Bailout That Saved Mitt Romney

Government documents prove the candidate's mythology is just that

According to the candidate's mythology, Romney took leave of his duties at the private equity firm Bain Capital in 1990 and rode in on a white horse to lead a swift restructuring of Bain & Company, preventing the collapse of the consulting firm where his career began. When The Boston Globe reported on the rescue at the time of his Senate run against Ted Kennedy, campaign aides spun Romney as the wizard behind a "long-shot miracle," bragging that he had "saved bank depositors all over the country $30 million when he saved Bain & Company."

In fact, government documents on the bailout obtained by Rolling Stone show that the legend crafted by Romney is basically a lie. The federal records, obtained under the Freedom of Information Act, reveal that Romney's initial rescue attempt at Bain & Company was actually a disaster – leaving the firm so financially strapped that it had "no value as a going concern." Even worse, the federal bailout ultimately engineered by Romney screwed the FDIC – the bank insurance system backed by taxpayers – out of at least $10 million. And in an added insult, Romney rewarded top executives at Bain with hefty bonuses at the very moment that he was demanding his handout from the feds.

RELATED LINKS

With his selection of Paul Ryan as his running mate, Romney has made fiscal stewardship the centerpiece of his campaign. A banner at MittRomney.com declared, "We have a moral responsibility not to spend more than we take in." Romney also opposed the federal bailout for Detroit automakers, famously arguing that the industry should be forced into bankruptcy. Government bailouts, he insists, are "the wrong way to go."

But the FDIC documents on the Bain deal – which were heavily redacted by the firm prior to release – show that as a wealthy businessman, Romney was willing to go to extremes to secure a federal bailout to serve his own interests. He had a lot at stake, both financially and politically. Had Bain & Company collapsed, insiders say, it would have dealt a grave setback to Bain Capital, where Romney went on to build a personal fortune valued at as much as $250 million. It would also have short-circuited his political career before it began, tagging Romney as a failed businessman unable to rescue his own firm.

"None of us wanted to see Bain be the laughingstock of the business world," recalls a longtime Romney lieutenant who asked not to be identified. "But Mitt's reputation was on the line."

Mitt Romney's Federal Bailout: The Documents

The trouble began in 1984, when Bain & Company spun off Bain Capital to engage in leveraged buyouts and put Romney in charge of the new operation. To free up money to invest in the new business, founder Bill Bain and his partners cashed out much of their stock in the consulting firm – leaving it saddled with about $200 million in debt. (Romney, though not a founder, reportedly profited from the deal.) "People will tell you that Bill raped the place clean, was greedy, didn't know when to stop," a former Bain consultant later conceded. "Did they take too much out of the firm? You bet."

The FDIC documents make clear what happened next: "Soon after the founders sold their equity," analysts reported, "business began to drop off." First came scandal: In the late 1980s, a Bain consultant became a key figure in an illegal stock manipulation scheme in London. The firm's reputation took a hit, and it fired 10 percent of its consulting force. By the time the 1989 recession began, Bain & Company found itself going broke fast. Cash flows weren't enough to service the debt imposed by the founders, and the firm could barely make payroll. In a panic, Bill Bain tapped Romney, his longtime protégé, to take the reins.

In Romney's own retelling, he casts himself as a selfless and loyal company man. "There was no upside," he told his cheerleading biographer Hugh Hewitt in 2007. "There was no particular reason to do it other than a sense of obligation and duty to an organization that had done great things for me."

In fact, Romney had a direct stake in the survival of Bain & Company: He had been working to build the Bain brand his entire career, and felt he had to save the firm at all costs. After all, Bain sold top-dollar strategic advice to big businesses about how to protect themselves from going bust. If Bain & Company went bankrupt, recalls the Romney deputy, "anyone associated with them would have looked clownish." Indeed, when a banker from Goldman Sachs urged Bain to consider bankruptcy as the obvious solution to the firm's woes, Romney's desperation began to show. He flatly refused to discuss it – and in the ensuing argument, one witness says, Romney almost ended up in a brawl when the Goldman banker advised him to "go fuck yourself." For the sake of Romney's career and fortune, bankruptcy was simply not an option – no matter who got screwed in the process.

According to the government records obtained by Rolling Stone, Bain & Company "defaulted on its debt obligations" at nearly the same time that "W. Mitt Romney . . . stepped in as managing director (and later chief executive) in 1990 and led the financial restructuring intended to get the firm back on track."

Romney moved decisively, and his early efforts appeared promising. He persuaded the founders to return $25 million of the cash they had raided from Bain & Company and forgive $75 million in debt, in return for protection from most future liabilities. Romney then consolidated Bain's massive debts into a single, binding loan agreement with four banks, which received liens on Bain's assets and agreed to delay repayments on the firm's debts for two years. The federal government also signed off on the deal, since the FDIC had recently taken control of a bank that was owed $30.6 million by Bain. Romney assured creditors that the restructuring would enable Bain to "operate normally, compensate its professionals competitively" and, ultimately, pay off its debts.

Almost as soon as the FDIC agreed to the loan restructuring, however, Romney's rescue plan began to fall apart. "The company realized early on that it would be unable to hit its revenue targets or manage the debt structure," the documents reveal. By the spring of 1992, Bain's decline was perilous: "If Bain goes into default," one analyst warned the FDIC, "the bank group will need to decide whether to force Bain into bankruptcy."

With his rescue plan a bust, Romney was forced to slink back to the banks to negotiate a new round of debt relief. There was only one catch: Even though Bain & Company was deep in debt and sinking fast, the firm was actually flush with cash – most of it from the looted money that Bill Bain and other partners had given back. "Liquidity is strong based on the significant cash balance which Bain is carrying," one federal document reads.

Under normal circumstances, such ample reserves would have made liquidating Bain an attractive option: Creditors could simply divvy up the stockpiled cash and be done with the troubled firm. But Bain had inserted a poison pill in its loan agreement with the banks: Instead of being required to use its cash to pay back the firm's creditors, the money could be pocketed by Bain executives in the form of fat bonuses – starting with VPs making $200,000 and up. "The company can deplete its cash balances by making officer-bonus payments," the FDIC lamented, "and still be in compliance with the loan documents."

What's more, the bonus loophole gave Romney a perverse form of leverage: If the banks and the FDIC didn't give in to his demands and forgive much of Bain's debts, Romney would raid the firm's coffers, pushing it into the very bankruptcy that the loan agreement had been intended to avert. The losers in this game would not only be Bain's creditors – including the federal government – but the firm's nearly 1,000 employees worldwide.

In March 1992, according to the FDIC documents, Romney approached the banks and played the bonus card. Allow Bain to pay off its debt at a deep discount, he demanded – just 35 cents on the dollar. Otherwise, the "majority" of the firm's "excess cash" would "be available for the bonus pool to its officers at a vice president level and above."

The next month, when the banks balked at the deal, Romney decided to prove he wasn't bluffing. "As the bank group did not accept the proposal from Bain," the records show, "Bain's senior management has decided to go forth with the distribution of bonuses." (Bain's lawyers redacted the amount of the executive payouts, and the Romney campaign refused to comment on whether Romney himself received a bonus.)

Romney's decision to place executive compensation over fiscal responsibility immediately put Bain on the ropes. By that July, FDIC analysts reported, Bain had so little money left that "the company will actually run out of cash and default on the existing debt structure" as early as 1995. If that happened, Bain employees and American consumers would take the hit – an alternative that analysts considered "catastrophic."

But Romney didn't dole out all of Bain's cash as bonuses right away. According to a record from May 1992, he set aside some of the money to put one last squeeze on the firm's creditors. Romney now demanded that the banks and the government agree to a deal that was even less favorable than the last – to retire Bain's debts "at a price up to but not exceeding 30 cents on the dollar."

The FDIC considered finding a buyer to take over its loans to Bain, but analysts concluded that "Bain has no value as a going concern." And the government wasn't likely to get much out of Bain if it allowed the firm to go bankrupt: The loan agreement engineered by Romney had left the FDIC "virtually unsecured" on the $30.6 million it was owed by Bain. "Once bonuses are paid," the analysts warned, "all members of the bank group believe this company will dissolve during 1993."

About the only assets left would be Bain's office equipment. The records show FDIC analysts pathetically attempting to assess the value of such items, including an HP LaserJet printer, before concluding that most of the gear was so old that the government's "portion of any liquidation proceeds would be negligible."

How had Romney scored such a favorable deal at the FDIC's expense? It didn't hurt that he had close ties to the agency – the kind of "crony capitalism" he now decries. A month before he closed the 1991 loan agreement, Romney promoted a former FDIC bank examiner to become a senior executive at Bain. He also had pull at the top: FDIC chairman Bill Seidman, who had served as finance chair for Romney's father when he ran for president in 1968.

The federal documents also reveal that, contrary to Romney's claim that he returned full time to Bain Capital in 1992, he remained involved in bailout negotiations to the very end. In a letter dated March 23rd, 1993, Romney reassured creditors that his latest scheme would return Bain & Company to "long-term financial stability." That same month, Romney once again threatened to "pay out maximum bonus distributions" to top executives unless much of Bain's debt was erased.

In the end, the government surrendered. At the time, The Boston Globe cited bankers dismissing the bailout as "relatively routine" – but the federal documents reveal it was anything but. The FDIC agreed to accept nearly $5 million in cash to retire $15 million in Bain's debt – an immediate government bailout of $10 million. All told, the FDIC estimated it would recoup just $14 million of the $30 million that Romney's firm owed the government.

It was a raw deal – but Romney's threat to loot his own firm had left the government with no other choice. If the FDIC had pushed Bain into bankruptcy, the records reveal, the agency would have recouped just $3.56 million from the firm.

The Romney campaign refused to respond to questions for this article; a spokeswoman said only that "Mitt Romney turned around Bain & Company by getting all parties to come to the table and make difficult decisions." But while taxpayers did not finance the bailout, the debt forgiven by the government was booked as a loss to the FDIC – and then recouped through higher insurance premiums from banks. And banks, of course, are notorious for finding ways to pass their costs along to customers, usually in the form of higher fees. Thanks to the nature of the market, in other words, the bailout negotiated by Romney ultimately wound up being paid by the American people.

Even as consumers took a loss, however, a small group of investors wound up getting a good deal in the bailout. Bain Capital – the very firm that had triggered the crisis in the first place – walked away with $4 million. That was the fee it charged Bain & Company for loaning the consulting firm the services of its chief executive – one Willard Mitt Romney.

This story is from the September 13, 2012 issue of Rolling Stone.

Thursday, August 30, 2012

Harvard Says 125 Students May Have Cheated on a Final Exam

Harvard Says 125 Students May Have Cheated on a Final Exam

An entrance to Harvard University in Cambridge, Mass.

By RICHARD PÉREZ-PEÑA

The accusations, related to a single undergraduate class in the spring semester, deal with “academic dishonesty, ranging from inappropriate collaboration to outright plagiarism,” the administration said in a note sent to students.

Officials said that nearly half of the more than 250 students in the class were under investigation by the Harvard College Administrative Board and that if they were found to have cheated, they could be suspended for a year. The students have been notified that they are suspected and will be called to give their accounts in investigative hearings.

“This is unprecedented in its scope and magnitude,” said Jay Harris, the dean of undergraduate education.

Administrators would not reveal the name of the class or even the department, saying that they wanted to protect the identities of the accused students. The Harvard Crimson, the university’s student newspaper, reported that it was a government class, Introduction to Congress, which had 279 students, and that it was taught by Matthew B. Platt, an assistant professor.

Professor Platt did not respond to messages seeking comment.

When final exams were graded in May, similarities were noticed in the answers given by some students, officials said, and a professor brought the matter to the administration immediately. Over the summer, Harvard’s administrative board conducted an initial review, going over the exams of all of the students in the class for evidence of cheating. It concluded that almost half of them showed signs of possible collaboration.

“The enabling role of technology is a big part of this picture,” Mr. Harris said. “It’s the ease of sharing. With that has come, I believe, a certain cavalier attitude.”

The university said it planned to increase efforts to teach students about academic integrity.

“The scope of the allegations suggests that there is work to be done to ensure that every student at Harvard understands and embraces the values that are fundamental to its community of scholars,” Harvard’s president, Drew Gilpin Faust, told The Harvard Gazette, the university’s official newspaper.

Harvard’s student handbook says that students must “comply with the policy on collaboration established for each course,” and notes that such policies vary from department to department, from class to class, and even from assignment to assignment within a class.

The news comes as Harvard students are returning to campus for the fall term, which begins on Tuesday.

DIGITAL MUSIC NEWS

Digital Music Market Will Grow 15% Annually To $22.5 Billion In 2017

| Pandora Beats Forecasts, Reports Break-Even Q2 Results

|

| Muve Founder: "One Day Music Will Be Like Voice Mail"

|

| Where There's A Will, There's No Legal Way To Transfer Digital Music

|

Townsquare Acquires MOG Music Ad Network

|

NSA spying violated 4th Amendment

Court ruling that NSA spying violated 4th Amendment remains secret

EFF sues US to uncover details of court decision on phone and e-mail spying.

by Jon Brodkin - Aug 30, 2012 11:40 pm UTC

Last month, a letter to Congress noted that “on at least one occasion” a secretive US court ruled that National Security Agency surveillance carried out under a 2008 act of Congress violated the Fourth Amendment’s restriction against unreasonable searches and seizures. But the actual ruling remains secret. Decisions handed down by the US’s Foreign Intelligence Surveillance Court (FISC) are classified “because of the sensitive intelligence matters they concern,” the letter from the Office of the National Intelligence Director to Sen. Ron Wyden (D-OR) states.

The explanation wasn’t good enough for the Electronic Frontier Foundation, which filed a Freedom of Information Act (FOIA) request for details on the FISC ruling or rulings. Today, the EFF followed that up with a lawsuit against the Department of Justice in US District Court in Washington, D.C., saying its July 26 FOIA request has not been processed within the 20-day deadline.

Details on a government ruling that the NSA violated the Constitution could help the EFF in its broader fight against warrantless wiretapping authority granted by the Foreign Intelligence Surveillance Amendments Act of 2008. While the FISA amendments in 2008 were designed to aid anti-terrorist operations, the EFF says it "gave the NSA expansive power to spy on Americans' international e-mail and telephone calls." The EFF lawsuit filed today says the FISC ruling or rulings should be made public because it concerns “possible questions about the government’s integrity which affect public confidence.” The lawsuit asks for a decision ordering the DOJ to make the records available immediately.

In an accompanying statement, the EFF said the requested records could also help Congress decide whether to allow the surveillance program to continue. "The surveillance provisions in the FAA [FISA Amendments Act] will sunset at the end of this year unless Congress reauthorizes the law,” the EFF said. “The pending congressional debate on reauthorization makes it all the more critical that the government release this information on the NSA's actions.”

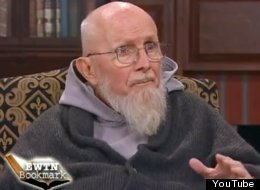

CATHOLIC PRIEST CLAIMS TEENS SEDUCE PRIESTS

Father Benedict Groeschel, American Friar,

Claims Teens Seduce Priests In Some Sex Abuse Cases

The Huffington Post | By Meredith Bennett-Smith

I grew up as a Catholic. Trained by Jesuits:) My values come from the New Testament and can be summed up in one word: compassion. The religious discussion in this country at least is not at all focused on the NT message; rather, it's all about sex. Values seem to arise from dark bits and pieces of the Old Testament, especially Leviticus. In the "enlightened" coastal progressive communities I rarely hear animated talk about, say, the Sermon on the Mount. Rather folks go on about how happy they are to masturbate and fuck freely now that they've renounced religion and god. On the right they go on about Xian values, meaning, as far as I can see, right to life and "defense" of marriage. Nothing, again, about treating others as you would like to be treated yourself. For them Xianity is somehow wrapped up with a notion of personal freedom without responsibility.

My personal problem with belief in the Church is basically this: after 2000 years of Xianity nothing has changed, fundamentally, in the way humans treat each other and the world around them. People bash each other for personal gain and happily soil the world around them. I see no New Testament values in action.

As for god or gods, I just don't know. When I remove myself from the "connectivity" and "me" focus of modern America I do sense that I belong to something vast and incomprehensible; an unquantifiable spirit than is shared by all living things. I used to have this knowledge of what truly is on the dancefloor. I have labeled this ecstatic understanding of the universal one...for my own purposes. Institutions don't seem to be able to communicate these concepts. The old Catholic church with it's ancient rituals and sense of mystery did this the best, I think, but that was lost in the rush for relevance. So we have our full moon and other rituals in our home. I still search for connection with the universal though the constant battle for survival these days makes success here almost impossible. I do know this: the new religion Science can neither prove nor disprove the existence of god or another spiritual realm. Like religion, Science promises eternal life some day as well as Truth. Science doesn't seem to produce, however, much happiness.

Wednesday, August 29, 2012

Hyperspectral Photography

Peeling Back the Hidden Pages of History With Hyperspectral Photography

- By John R. Quain on August 21, 2012

"Hyperspectral images will be able to see past the damage to words that haven’t been seen by human eyes for more than 2,000 years."

One of the first major successes in hyperspectral imaging involved analysis of the so-called Archimedes Palimpsest. In 1999, after a 13th-century prayer book was purchased by an anonymous collector, it was deposited at the Walters Art Museum in Baltimore to allow scholars to conserve and study the tome’s palimpsests—pages that had been erased and reused. Hyperspectral analysis in 2000 confirmed that while the visible text was from the 13th century, the pages were actually hundreds of years older. It took a team of imaging researchers including William A. Christens-Barry, chief scientist at Equipoise Imaging, several years to illuminate the original contents of what had been erased, but the payoff was significant: two lost treatises by the ancient Greek mathematician and astronomer Archimedes (The Method and Stomachion), as well as a speech by the 4th-century BCE Athenian orator Hyperides and a 3rd-century CE commentary on Aristotle’s Categories.

When the hyperspectral eye was turned on an early draft of the Declaration of Independence written in Thomas Jefferson’s hand, researchers could see that Jefferson had originally written the word “subjects” on one line, which he then scratched out and replaced with the more politically correct “citizens,” exemplifying the egalitarian sensibility of one of the Enlightenment’s greatest minds.

“We can clearly show what text was put down first,” says Fenella France, of the Library of Congress’s Preservation Research and Testing Division. France also notes that extreme-angle raking lights can be used to reveal what is essentially the topography of a document and how it was made. Researchers hope this technique will confirm that the paper this draft of the Declaration of Independence was written on bears—with poetic irony—the official watermark of King George III.

Importantly for conservationists, such results have been obtained without exposing the rare documents to excessive light, which can age and damage historic texts even further. “We believe in adhering to the Hippocratic oath of imaging: Do no harm,” says Ken Boydston, president of MegaVision. Because it shoots multiple images in such narrow bands, the hyperspectral system uses up to 1,000 times less light than a conventional high-resolution imaging system.

Expand

Expand This combination of ultra-high-resolution photography with low-light exposure recently prompted the Israel Antiquities Authority (IAA) to begin using a MegaVision-designed system at the Israel Museum campus in Jerusalem, where some of the Dead Sea Scrolls reside.

Discovered in a series of caves in the Judean Desert from 1947 to 1956, the scrolls comprise roughly 900 different texts spread across tens of thousands of fragments, ranging in size from that of a dime to half a standard sheet of paper. More than two millennia old, the scrolls are some of the most valuable religious documents ever discovered and include texts that appear in Hebrew and Christian scripture, offering unique insights into the genesis of modern Judaism and Christianity.

Scholars have struggled to piece together and translate the more than 300 different works, but there have always been gaps, including many blackened areas, an artifact of their being recorded on animal skins. Over the centuries, the collagen in the parchment becomes gelatinized, causing certain sections to darken. Eventually they’re rendered illegible.

With the IAA project, hyperspectral images will be able to see past this damage to words that haven’t been seen by human eyes for more than 2,000 years and yield the ultra-high-resolution images researchers crave. According to Pnina Shor, curator and head of the Dead Sea Scrolls projects at the IAA, as many as 57 different images will be created of each fragment. With more than 100,000 fragments in the collection, it will be years before the work is finished. Happily, through a partnership with Google, the fragment images will be made available by the IAA online as they are completed. (Last year, a different set of high-resolution images of some scrolls housed at the Israel Museum’s Shrine of the Book were placed online, also in conjunction with Google.)

Meanwhile, MegaVision’s Boydston has been traveling back and forth to a remote monastery in the Sinai desert. St. Catherine’s Monastery is home to what may be one of the world’s oldest surviving libraries, a cache of ancient manuscripts and documents that has yielded remarkable discoveries. It was there in 1892 that twin sisters from Scotland, Agnes Smith Lewis and Margaret Dunlop Gibson, traveled by camel and braved sand storms and rocky terrain to discover what turned out to be one of the earliest known copies of the Christian Gospels, believed to have been translated around the 2nd century A.D. It was also at St. Catherine’s that the German scholar Constantin von Tischendorf found—and removed—in 1859 what would become known as Codex Sinaiticus. Inscribed around the 4th century, it is recognized as one of the oldest and most complete manuscripts of the Bible ever found.

Expand

Expand Armed with one of the MegaVision-based hyperspectral systems, a new team of researchers and scholars from the Early Manuscripts Electronic Library group, a charitable organization working to digitize and preserve rare manuscripts around the world, are now beginning work on a survey of some 120 palimpsests in the St. Catherine’s library. Boydston has been helping the team set up the camera system, which he expects will help the researchers to discover important texts that have eluded previous scholars.

In the meantime, researchers have found additional—and more contemporary—applications for the hyperspectral imaging technology. France notes that conservationists are using the data accumulated from the imaging to assess how well preservation techniques are working, for example. Scientists can now see changes beyond the visible wavelengths that can show early signs of aging or damage and make environmental adjustments before more serious deterioration occurs. Other researchers are interested in the possible use of such systems in the area of forensic analysis.

During one lengthy imaging session at the Library of Congress—it can sometimes take many hours to finish photographing a single document—a raised swirl appeared on the screen. Researchers were examining a copy of the Gettysburg Address, thought by some to be the version Abraham Lincoln used to deliver his 1863 speech. It turned out they were staring at what could possibly be a 149-year-old fingerprint of the 16th president. That discovery led to further research to compare the image with fingerprints on other documents to see if scholars could confirm that it was indeed President Lincoln’s fingerprint (the results of these recent investigations have yet to be published). Researchers also hope to use some of the same techniques to cold-case criminal investigations, but the painstaking work and costly equipment (at $50,000 to $100,000) make the systems prohibitive to apply.

Expand

Expand The historic discoveries are just getting started. No one yet knows how much researchers and scholars will find with this new generation of hyperspectral technology. More than a hundred years ago, in the ancient Egyptian city of Oxyrhynchus, archeologists found piles of illegible papyrus. Recently, University of Oxford researchers found that they contained fragments of a lost tragedy by the ancient author Sophocles, of whose plays only seven were known to have survived. New imaging methods have also found portions of a poem by Archilochus that reveal new details about the genesis of the Trojan War. The research at St. Catherine’s could settle long-standing debates over the origins and foundation of some of the world’s major religions.

France notes, however, that uncovering corrections or amendments in historical documents doesn’t necessarily end the discussion: “We tend to open up more questions than we answer,” she says. We say amen to that. AP